1. What is a GST Invoice?

2. Who should issue GST Invoice?

3. What are the mandatory fields a GST Invoice should have?

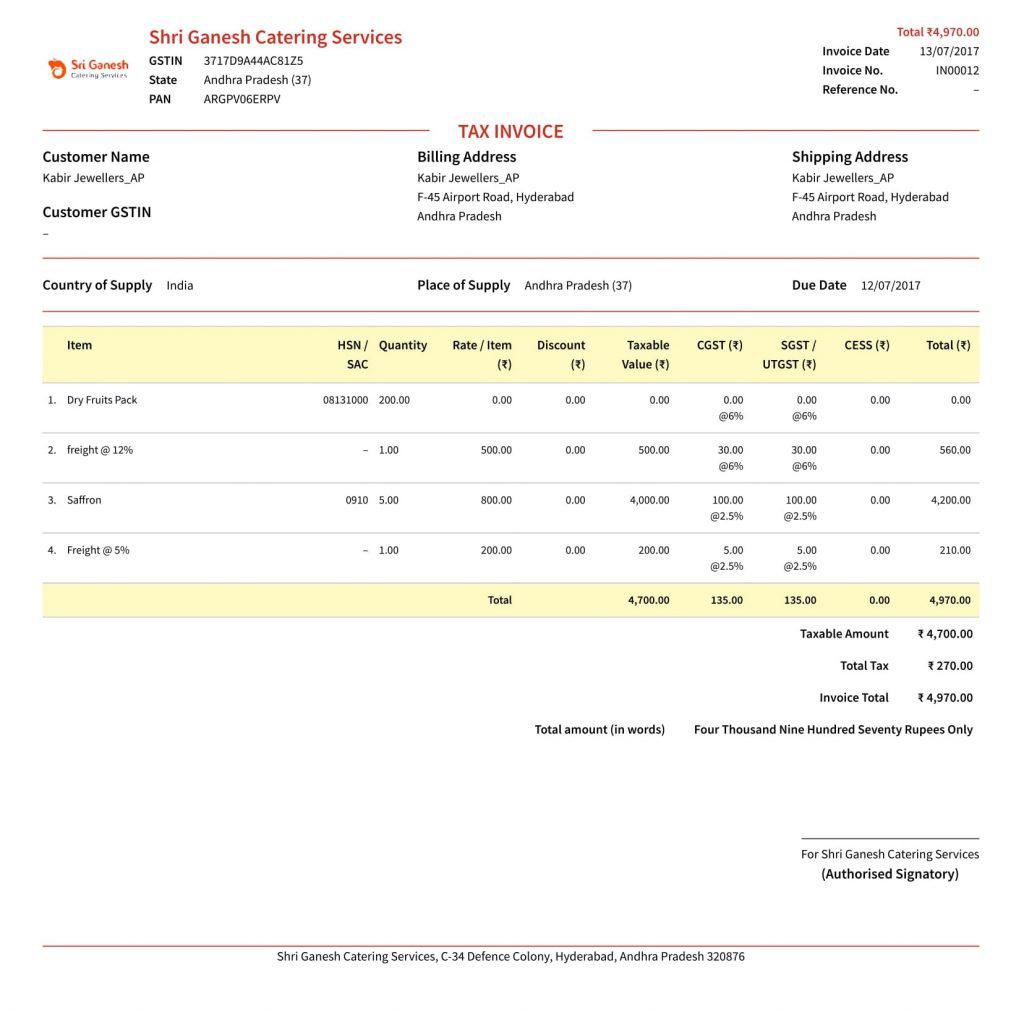

- Invoice number and date

- Customer name

- Shipping and billing address

- Customer and taxpayer’s GSTIN (if registered)**

- Place of supply

- HSN code/ SAC code

- Item details i.e. description, quantity (number), unit (meter, kg etc.), total value

- Taxable value and discounts

- Rate and amount of taxes i.e. CGST/ SGST/ IGST

- Whether GST is payable on reverse charge basis

- Signature of the supplier

4. By when should you issue invoices?

5. How to personalize GST Invoices?

6. What are other types of invoices?

6.A. Bill of Supply

- Registered person is selling exempted goods/services,

- Registered person has opted for composition scheme

Invoice-cum-bill of supply

6.B. Aggregate Invoice

6.C. Debit and credit note

- Tax invoice has a lower taxable value than the amount that should have been charged

- Tax invoice has a lower tax value than the amount that should have been charged

- Tax invoice has a higher taxable value than the amount that should have been charged

- Tax invoice has a higher tax value than the amount that should have been charged

- Buyer refunds the goods to the supplier

- Services are found to be deficient

7. Can you revise invoices issued before GST?

8. How many copies of Invoices should be issued?

No comments:

Post a Comment